PDFWAC 480-30-426

Tariffs, general rate increase filings, work papers.

(1) General rate increase filings must include work papers supporting the proposed tariff changes based on a test year which is the most recent or appropriate consecutive twelve-month period for which financial data are available. Work papers must include, but are not limited to, the following:

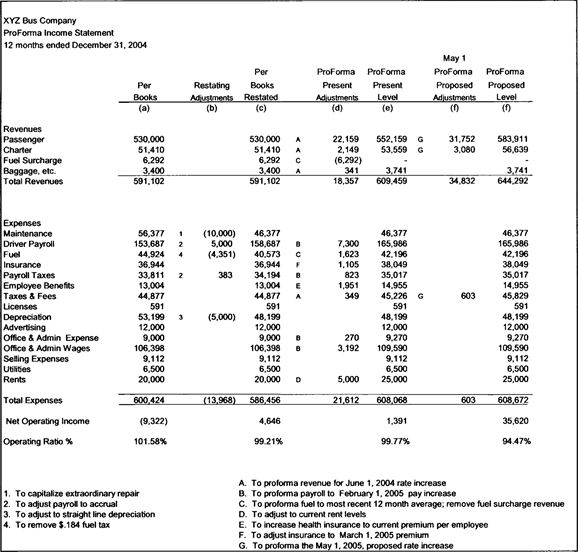

(a) A detailed pro forma income statement by account including restating and pro forma adjustments, and all supporting calculations and documentation for each adjustment. See sample pro forma income statement below.

(i) Restating adjustments modify historic operating results to more properly reflect a "normal, representative" twelve-month test period and give recognition to those areas where the company's accounting methodology may differ from accepted regulatory practice. Restating adjustments fall into three categories:

(A) Reclassification - Reclassification moves dollars from one account to another with no effect on the final net income.

(B) Accounting adjustments - Accounting adjustments are necessary if the income statement does not properly apply basic accounting principles, such as an out-of-period expense posted in the test year, or to correct an error or oversight.

(C) Ratemaking - Ratemaking adjustments modify the records of the company to reflect proper ratemaking theory, such as removing expenses that were incurred by the company but are not generally allowed to be passed on to ratepayers, or converting from accelerated depreciation to straight line depreciation.

(ii) Pro forma adjustments give effect to all known and measurable changes in revenues and expenses not offset by other factors that have or will soon occur as if they had been in effect for the full twelve months of the test year. Examples include changes in tax rates, revenue impact of the tariff changes sought to be changed in the filing. Pro forma adjustments give effect to changes in expense or revenue levels, not the gallons of fuel used, passengers transported, or labor hours worked, etc.

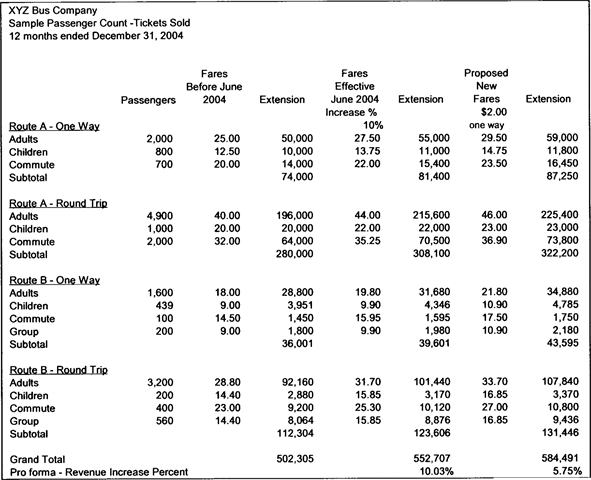

(b) A total passenger count or representative sample of all tickets sold and fares charged during the test year, including all routes, zones, and types of service, and breakdowns between one-way and round trip fares, adults, children, commuters, etc. Revenues of the passenger count/tickets sold analysis must be reconciled to the revenues of the chosen test period. The passenger count/tickets sold analysis forms the basis of the revenue impact of the filing called for in WAC 480-30-381 (2)(b)(ii). See sample passenger count below.

(c) A current depreciation schedule separately listing all assets used by the company during the test period including the date the asset was placed into service, cost, salvage value, service life, and straight-line depreciation expense and accumulated depreciation at the beginning and at the end of the test period.

(d) A balance sheet as of the last day of the test period chosen.

(e) If nonregulated operations represent more than ten percent of total company test period revenue, then the starting point of the pro forma income statement must be total company operations, supplemented with a detailed separation of all total company revenues and expenses between regulated and nonregulated operations.

(f) Backup information concerning every transaction between the regulated company and any affiliated or subsidiary entity describing the services or transactions that occurred, the costs assessed and the basis of the charge, and the relationship to the regulated company.

Sample - Pro forma income statement

|

Sample - Passenger count

|