PDFWAC 173-424-570

Credit clearance market.

(1) General. If a regulated party owes more than the allowed small deficit under WAC 173-424-500(4), it must enter and purchase its pro-rata share of credits in the credit clearance market under subsection (5) of this section.

(a) The credit clearance market is separate from the normal year-round market opportunities for parties to engage in credit transactions.

(b) Ecology will consider a regulated party in compliance with WAC 173-424-500 if it acquires its pro-rata obligation in the credit clearance market and retires that number of credits within 30 days of the end of the credit clearance market.

(2) Maximum price. The maximum price for the credit clearance market must be:

(a) Two hundred U.S. dollars in 2018 per credit for the markets held upon the submission of the annual reports for compliance year 2023.

(b) For markets held upon submission of annual reports in 2023/2024 and thereafter ecology shall adjust the maximum price for the credit clearance market annually for inflation at the end of each January using the inflation rate as provided by the last 12 months of data from the U.S. Bureau of Labor Statistics West Region Consumer Price Index for All Urban Consumers for All Items. The formula for that adjustment is as follows:

maximum price = [Last year's maximum price] * (1 + [CPI-U West])

Ecology will publish the new maximum price on its web page on the first Monday of April each year.

(3) Acquisition of credits in the credit clearance market. The credit clearance market will operate from June 1st to July 31st.

(a) Regulated parties subject to subsection (1) of this section must acquire their pro-rata share of the credits in the credit clearance market calculated in subsection (5) of this section.

(b) A regulated party may only use credits acquired in the credit clearance market to retire them against its unmet compliance obligation from the prior year.

(c) To qualify for compliance through the credit clearance market, the regulated party in question must have:

(i) Retired all credits in its possession; and

(ii) Have an unmet compliance obligation for the prior year that has been reported to ecology through submission of its annual report in the WFRS.

(4) Selling credits in the clearance market.

(a) On the first Monday in April each year, ecology shall issue a call to all eligible registered parties in the WFRS to pledge credits into the credit clearance market, or will issue a notification that it will not hold a credit clearance market that year. Registered parties are eligible to sell credits in the clearance market if they will have excess credits upon the submission of their annual report. Parties wanting to pledge credits into the credit clearance market will notify ecology by April 30th. Ecology will announce if a clearance market will occur by May 15th.

(b) In order to participate in the credit clearance market, sellers must:

(i) Agree that they will sell their credits for no higher than the maximum price as published by ecology for that year;

(ii) Agree to withhold any pledged credits from sale in any transaction outside of the credit clearance market until the end of the credit clearance market on July 31st, or if no clearance market is held in a given year, then on the date which ecology announces it will not be held;

(iii) Not reject an offer to purchase the credits at the maximum price for that year as published by ecology, unless the seller has already sold or agreed to sell those pledged credits to another regulated party participating in the credit clearance market; and

(iv) Agree to replace any credits that the seller pledges into the clearance market if those credits are later found to be invalid by ecology due to fraud or noncompliance by the generator of the credit, unless the buyer of the credits was a party to that fraud or noncompliance.

(5) Operation of the credit clearance market. Prior to June 1st, ecology will inform each regulated party that failed to meet its annual compliance obligation under WAC 173-424-500 of its pro-rata share of the credits pledged into the credit clearance market.

(a) Calculation of pro-rata shares.

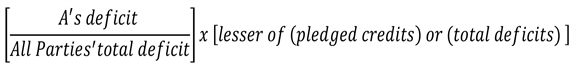

(i) Each regulated party's pro-rata share of the credits pledged into the credit clearance market will be calculated by the following formula:

Regulated Party A's pro-rata share =

|

(A) "Deficit" refers to the regulated party's total obligation for the prior compliance year that has not been met under WAC 173-424-500;

(B) "All parties' total deficit" refers to the sum of all of the unmet compliance obligations of all regulated parties in the credit clearance market; and

(C) "Pledged credits" refers to the sum of all credits pledged for sale into the credit clearance market.

(ii) If there is at least one large producer or importer of finished fuels participating in the credit clearance market, ecology will determine the pro-rata share of the available credits in two phases.

(A) The first phase will begin with all of the credits pledged into the credit clearance market and the deficits from large producers or importers of finished fuels in place of "all parties' total deficit" in (a)(i)(B) of this subsection.

(B) The second phase will begin with the remainder of the pledged credits into the credit clearance market in place of "pledged credits" in (a)(i)(C) of this subsection and the deficits from all other regulated parties in place of "all parties' total deficit" in (a)(i)(B) of this subsection.

(C) The calculation for each phase will be done as in (a)(i) of this subsection.

(b) On or before June 1st, ecology will post the name of each party that is participating in the credit clearance market as a buyer, and the name of each party that is participating as a seller in the market and the number of credits they have pledged into the market.

(c) Following the close of the credit clearance market, each regulated party that was required to purchase credits in the credit clearance market must submit an amended annual compliance report in the WFRS by August 31st which shows the acquisition and retirement of its pro-rata share of credits purchased in the credit clearance market, and any remaining unmet deficits.

(6) If a regulated party has unmet deficits upon the submission of the amended annual compliance report, ecology will increase the regulated party's number of unmet deficits by five percent and the total unmet deficits will be carried over into the next compliance period for that regulated party.

(7) If the same regulated party has been required to participate in two consecutive credit clearance markets and carries over deficits under subsection (6) of this section in both markets, ecology will conduct a root cause analysis into the inability of that regulated party to retire the remaining deficits.

(a) If multiple regulated parties are subject to this section in a single year, ecology may produce a single root cause analysis for those regulated parties if it determines the same general set of causes contributed to those parties' inability to retire those deficits. Ecology will also analyze whether there were specific circumstances for the individual parties.

(b) Based on the results of the root cause analysis, ecology may issue a deferral under WAC 173-424-720 or craft a remedy that addresses the root cause or causes. The remedy cannot:

(i) Require a regulated party to purchase credits for an amount that exceeds the maximum price for credits in the most recent credit clearance market; or

(ii) Compel a registered party to sell credits.

[Statutory Authority: Chapter 70A.535 RCW. WSR 22-24-004 (Order 21-04), § 173-424-570, filed 11/28/22, effective 12/29/22.]

Reviser's note: The brackets and enclosed material in the text of the above section occurred in the copy filed by the agency.