Chapter 173-424 WAC

Last Update: 11/28/22CLEAN FUELS PROGRAM RULE

WAC Sections

PART 1 - OVERVIEW | ||

| HTMLPDF | 173-424-100 | Purpose. |

| HTMLPDF | 173-424-110 | Definitions. |

| HTMLPDF | 173-424-120 | Applicability. |

| HTMLPDF | 173-424-130 | Exemptions. |

| HTMLPDF | 173-424-140 | General requirements. |

PART 2 – DESIGNATION OF REGULATED PARTIES AND CREDIT GENERATORS | ||

| HTMLPDF | 173-424-200 | Designation of fuel reporting entities for liquid fuels. |

| HTMLPDF | 173-424-210 | Fuel reporting entities for gaseous fuels. |

| HTMLPDF | 173-424-220 | Designation of fuel reporting entity for electricity. |

PART 3 - REGISTRATION | ||

| HTMLPDF | 173-424-300 | Registration. |

PART 4 – RECORDKEEPING AND REPORTING | ||

| HTMLPDF | 173-424-400 | Recordkeeping. |

| HTMLPDF | 173-424-410 | Quarterly reports. |

| HTMLPDF | 173-424-420 | Specific reporting requirements. |

| HTMLPDF | 173-424-430 | Annual compliance reports. |

PART 5 – DEMONSTRATING COMPLIANCE | ||

| HTMLPDF | 173-424-500 | Demonstrating compliance. |

| HTMLPDF | 173-424-510 | Credit and deficit basics. |

| HTMLPDF | 173-424-520 | Fuels to include in credit and deficit calculation. |

| HTMLPDF | 173-424-530 | Transacting credits. |

| HTMLPDF | 173-424-540 | Calculating credits and deficits. |

| HTMLPDF | 173-424-550 | Advance crediting. |

| HTMLPDF | 173-424-560 | Generating and calculating credits for ZEV fueling infrastructure pathways. |

| HTMLPDF | 173-424-570 | Credit clearance market. |

PART 6 – OBTAINING CARBON INTENSITY VALUES FOR FUEL PATHWAYS | ||

| HTMLPDF | 173-424-600 | Carbon intensities. |

| HTMLPDF | 173-424-610 | Obtaining a carbon intensity. |

| HTMLPDF | 173-424-620 | Energy economy ratio-adjusted carbon intensity applications. |

| HTMLPDF | 173-424-630 | Determining the carbon intensity of electricity. |

PART 7 - OTHERS | ||

| HTMLPDF | 173-424-700 | Authority to suspend, revoke, or modify. |

| HTMLPDF | 173-424-710 | Public disclosure. |

| HTMLPDF | 173-424-720 | Emergency deferral. |

| HTMLPDF | 173-424-730 | Forecast deferral. |

PART 8 – VALIDATION AND VERIFICATION | ||

| HTMLPDF | 173-424-800 | Validation and verification. |

PART 9 – TABLES | ||

| HTMLPDF | 173-424-900 | Tables. |

PART 1 - OVERVIEW

PDF173-424-100

Purpose.

This rule establishes requirements for suppliers and consumers of certain transportation fuels in Washington in order to reduce the lifecycle greenhouse gas emissions per unit energy (carbon intensity) of transportation fuels used in the state.

[Statutory Authority: Chapter 70A.535 RCW. WSR 22-24-004 (Order 21-04), § 173-424-100, filed 11/28/22, effective 12/29/22.]

PDF173-424-110

Definitions.

Except as provided elsewhere in this chapter, the definitions in this section apply throughout the chapter:

(1) "Above the rack" means sales of transportation fuel at pipeline origin points, pipeline batches in transit, barge loads in transit, and at terminal tanks before the transportation fuel has been loaded into trucks.

(2) "Advance credits" refers to credits advanced under WAC 173-424-550 for actions that will result in reductions of the carbon intensity of Washington's transportation fuels.

(3) "Aggregation indicator" means an identifier for reported transactions that are a result of an aggregation or summing of more than one transaction in Washington fuels reporting system (WFRS). An entry of "true" indicates that multiple transactions have been aggregated and are reported with a single transaction number. An entry of "false" indicates that the transaction record represent a single fuel transaction.

(4) "Aggregator" or "credit aggregator" means a person who registers to participate in the clean fuels program, described in WAC 173-424-140(3), on behalf of one or more credit generators to facilitate credit generation and to trade credits.

(5) "Aggregator designation form" means an ecology-approved document that specifies that a credit generator has designated an aggregator to act on its behalf.

(6) "Alternative fuel" means any transportation fuel that is not gasoline or a diesel fuel, including those fuels specified in WAC 173-424-120(2).

(7) "Alternative fuel portal" or "AFP" means the portion of the WFRS where fuel producers can register their production facilities and submit fuel pathway code applications and physical pathway demonstrations.

(8) "Alternative jet fuel" means a fuel made from petroleum or nonpetroleum sources that can be blended and used with conventional petroleum jet fuels without the need to modify aircraft engines and existing fuel distribution infrastructure. To generate credits under this CFP, such fuel must have a lower carbon intensity than the applicable annual carbon intensity standard in Table 2 of WAC 173-424-900. Alternative jet fuel includes those jet fuels derived from co-processed feedstocks at a conventional petroleum refinery.

(9) "Animal fat" means the inedible fat that originates from a rendering facility as a product of rendering the by-products from meat processing facilities including animal parts, fat, and bone. "Yellow grease" must be reported under an applicable animal fat pathway if evidence is not provided to the verifier or ecology to confirm the quantity that is animal fat and the quantity that is used cooking oil.

(10) "Application" means the type of vehicle where the fuel is consumed in terms of LDV/MDV for light-duty vehicle/medium-duty vehicle or HDV for heavy-duty vehicle.

(11) "Backstop aggregator" means a qualified entity approved by ecology under WAC 173-424-220 to aggregate credits for electricity used as a transportation fuel, when those credits would not otherwise be generated.

(12) "Base credits" refers to electricity credits that are generated by the carbon reduction between the gasoline or diesel standard and the carbon intensity of utility electricity.

(13) "Battery electric vehicle" or "BEV" means any vehicle that operates solely by use of a battery or battery pack, or that is powered primarily through the use of an electric battery or battery pack but uses a flywheel or capacitor that stores energy produced by the electric motor or through regenerative braking to assist in vehicle operation.

(14) "Below the rack" means sales of clear or blended gasoline or diesel fuel where the fuel is being sold as a finished fuel for use in a motor vehicle.

(15) "Bill of lading" means a document issued that lists goods being shipped and specifies the terms of their transport.

(16) "Bio-CNG" means biomethane which has been compressed to CNG. Bio-CNG has equivalent performance characteristics when compared to fossil CNG.

(17) "Biodiesel" means a motor vehicle fuel consisting of mono alkyl esters of long chain fatty acids derived from vegetable oils, animal fats, or other nonpetroleum resources, not including palm oil, designated as B100 and complying with ASTM D6751.

(18) "Biodiesel blend" means a fuel comprised of a blend of biodiesel with petroleum-based diesel fuel, designated BXX. In the abbreviation BXX, the XX represents the volume percentage of biodiesel fuel in the blend.

(19) "Bio-L-CNG" means biomethane which has been compressed, liquefied, regasified, and recompressed into L-CNG, and has performance characteristics at least equivalent to fossil L-CNG.

(20) "Bio-LNG" means biomethane which has been compressed and liquefied into LNG. Bio-LNG has equivalent performance characteristics when compared to fossil LNG.

(21) "Biogas" means gas comprised primarily of methane and carbon dioxide, produced by the anaerobic decomposition of organic matter in a landfill, lagoon, or constructed reactor (digester). Biogas often contains a number of other impurities, such as hydrogen sulfide, and it cannot be directly injected into natural gas pipelines or combusted in most natural-gas-fueled vehicles unless first upgraded to biomethane. It can be used as a fuel in boilers and engines to produce electrical power.

(22) "Biomass" means nonfossilized and biodegradable organic material originating from plants, animals, or microorganisms, including: Products, by-products, residues and waste from agriculture, forestry, and related industries; the nonfossilized and biodegradable organic fractions of industrial and municipal wastes; and gases and liquids recovered from the decomposition of nonfossilized and biodegradable organic material.

(23) "Biomass-based diesel" means a biodiesel or a renewable diesel.

(24) "Biomethane" means methane derived from biogas, or synthetic natural gas derived from renewable resources, including the organic portion of municipal solid waste, which has been upgraded to meet standards for injection to a natural gas common carrier pipeline, or for use in natural gas vehicles, natural gas equipment, or production of renewable hydrogen. Biomethane contains all of the environmental attributes associated with biogas and can also be referred to as renewable natural gas.

(25) "Blendstock" means a fuel component that is either used alone or is blended with one or more other components to produce a finished fuel used in a motor vehicle. Each blendstock corresponds to a fuel pathway in the Washington Greenhouse Gases, Regulated Emissions, and Energy use in Transportation version 3.0 (WA-GREET 3.0) model, (November 28, 2022), which is incorporated herein by reference. A blendstock that is used directly as a transportation fuel in a vehicle is considered a finished fuel.

(26) "British thermal unit" or "Btu" means a measure of the heat content of fuels or energy sources. It is the quantity of heat required to raise the temperature of one pound of liquid water by one degree Fahrenheit at the temperature that water has its greatest density (approximately 39 degrees Fahrenheit).

(27) "Brown grease" means an emulsion of fat, oil, grease, solids, and water separated from wastewater in a grease interceptor (grease trap) and collected for use as a fuel feedstock. Brown grease must be reported under an applicable used cooking oil (UCO) pathway, i.e., reported as "unprocessed UCO" only if evidence is provided to the verifier or ecology to confirm that it has not been processed prior to receipt by the fuel production facility.

(28) "Bulk system" means a fuel distribution system consisting of refineries, pipelines, vessels, and terminals. Fuel storage and blending facilities that are not fed by pipeline or vessel are considered outside the bulk transfer system.

(29) "Business partner" refers to the second party that participates in a specific transaction involving the regulated party. This can either be the buyer or seller of fuel, whichever applies to the specific transaction.

(30) "Buy/sell board" means a section of the WFRS where registered parties can post that they are interested in buying or selling credits.

(31) "Carbon intensity" or "CI" means the amount of lifecycle greenhouse gas emissions per unit of energy of fuel expressed in grams of carbon dioxide equivalent per megajoule (gCO2e/MJ).

(32) "Cargo handling equipment" or "CHE" means any off-road, self-propelled vehicle or equipment, other than yard trucks, used at a port or intermodal rail yard to lift or move container, bulk, or liquid cargo carried by ship, train, or another vehicle, or used to perform maintenance and repair activities that are routinely scheduled or that are due to predictable process upsets. Equipment includes, but is not limited to, rubber-tired gantry cranes, top handlers, side handlers, reach stackers, loaders, aerial lifts, excavators, tractors, and dozers.

(33) "Carryback credit" means a credit that was generated during or before the prior compliance period that a regulated party acquires between January 1st and April 30th of the current compliance period to meet its compliance obligation for the prior compliance period.

(34) "Clean fuel standard" or "low carbon fuel standard" means the annual average carbon intensity a regulated party must comply with, as listed in Table 1 under WAC 173-424-900 for gasoline and gasoline substitutes and in Table 2 under WAC 173-424-900 for diesel fuel and diesel substitutes.

(35) "Clear diesel" means a light middle or middle distillate grade diesel fuel derived from crude oil that has not been blended with a renewable fuel.

(36) "Clear gasoline" means gasoline derived from crude oil that has not been blended with a renewable fuel.

(37) "Compliance period" means each calendar year during which regulated parties must demonstrate compliance under WAC 173-424-140.

(38) "Compressed natural gas" or "CNG" means natural gas stored inside a pressure vessel at a pressure greater than the ambient atmospheric pressure.

(39) "Conventional jet fuel" means aviation turbine fuel including commercial and military jet fuel. Commercial jet fuel includes products known as Jet A, Jet A-1, and Jet B. Military jet fuel includes products known as JP-5 and JP-8.

(40) "Co-processing" means the processing and refining of renewable or alternative low-carbon feedstocks intermingled with crude oil and its derivatives at petroleum refineries.

(41) "Credit facilitator" means a person in the WFRS that a regulated party designates to initiate and complete credit transfers on behalf of the regulated party.

(42) "Credit generator" means a person eligible to generate credits by providing clean fuels for use in Washington and who voluntarily registers to participate in the clean fuels program.

(43) "Credits" and "deficits" mean the units of measure used for determining a regulated entity's compliance with the average carbon intensity requirements in WAC 173-424-900. Credits and deficits are denominated in units of metric tons of carbon dioxide equivalent (CO2e), and are calculated pursuant to WAC 173-424-540 and 173-424-560.

(44) "Crude oil" means any naturally occurring flammable mixture of hydrocarbons found in geologic formations.

(45) "Day" means a calendar day unless otherwise specified as a business day.

(46) "Deferral" means a delay or change in the applicability of a scheduled applicable clean fuel standard for a period of time, accomplished pursuant to an order issued under WAC 173-424-720 or 173-424-730 as directed under RCW 70A.535.110 and 70A.535.120.

(47) "Deficit generator" means a fuel reporting entity who generates deficits in the CFP program.

(48) "Denatured fuel ethanol" or "ethanol" means nominally anhydrous ethyl alcohol meeting ASTM D4806 standards. It is intended to be blended with gasoline for use as a fuel in a spark-ignition internal combustion engine. Before it is blended with gasoline, the denatured fuel ethanol is first made unfit for drinking by the addition of substances approved by the Alcohol and Tobacco Tax and Trade Bureau.

(49) "Diesel fuel" or "diesel" means either:

(a) A light middle distillate or middle distillate fuel suitable for compression ignition engines blended with not more than five volume percent biodiesel and conforming to the specifications of ASTM D975; or

(b) A light middle distillate or middle distillate fuel blended with at least five and not more than 20 volume percent biodiesel suitable for compression ignition engines conforming to the specifications of ASTM D7467.

(50) "Direct current fast charging" means charging an electric vehicle at 50 kW and higher using direct current.

(51) "Disproportionately impacted communities" means communities that are identified by the department of health pursuant to chapters 70A.02 and 19.405 RCW.

(52) "Distiller's corn oil" has the same meaning as "technical corn oil."

(53) "Distiller's sorghum oil" has the same meaning as "technical sorghum oil."

(54) "Duty-cycle testing" means a test procedure used for emissions and vehicle efficiency testing.

(55) "E10" means gasoline containing 10 volume percent fuel ethanol.

(56) "E100" also known as "denatured fuel ethanol," means nominally anhydrous ethyl alcohol.

(57) "Ecology" means the Washington state department of ecology.

(58) "Electric cargo handling equipment (eCHE)" means cargo handling equipment using electricity as the fuel.

(59) "Electric ground support equipment (eGSE)" means self-propelled vehicles used off-road at airports to support general aviation activities that use electric batteries for propulsion and functional energy and only has electric motors. For the purpose of this rule that includes, but is not limited to, pushbacks, belt loaders, and baggage tractors.

(60) "Electric power for ocean-going vessel (eOGV)" means shore power provided to an ocean going vessel at-berth.

(61) "Electric transport refrigeration units (eTRU)" means refrigeration systems powered by electricity designed to refrigerate or heat perishable products that are transported in various containers including, but not limited to, semi-trailers, truck vans, shipping containers, and rail cars.

(62) "Electric vehicle (EV)," for purposes of this regulation, refers to battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs).

(63) "Emergency period" is the period of time in which an emergency action under WAC 173-424-720 is in effect.

(64) "Energy economy ratio (EER)" means the dimensionless value that represents the efficiency of a fuel as used in a powertrain as compared to a reference fuel used in the same powertrain.

(a) EERs are often a comparison of miles per gasoline gallon equivalent (mpge) between two fuels.

(b) EERs for fixed guideway systems are based on MJ/number of passenger-miles.

(65) "Environmental attribute" means greenhouse gas emission reduction recognition in any form, including verified emission reductions, voluntary emission reductions, offsets, allowances, credits, avoided compliance costs, emission rights and authorizations under any law or regulation, or any emission reduction registry, trading system, or reporting or reduction program for greenhouse gas emissions that is established, certified, maintained, or recognized by any international, governmental, or nongovernmental agency.

(66) "Export" means transportation fuel reported in the WFRS that is delivered from locations within Washington state to locations outside of Washington state by any means of transport, other than in the fuel tank of a motor vehicle for the purpose of propelling the motor vehicle.

(67) "Feedstock transfer document" means a document, or combination of documents, that demonstrates the delivery of specified source feedstocks from the point of origin to the fuel production facility as required under WAC 173-424-600(6).

(68) "Ferry vessel" means a vessel 65 feet or greater designed for operations on lakes, bays, and sounds, built to 46 C.F.R. Subchapter H, K, or T standard that is used on a regular schedule to:

(a) Provide transportation only between places that are not more than 300 miles apart;

(b) Transport only:

(i) Passengers; or

(ii) Vehicles, or railroad cars, that are being used, or have been used, in transporting passengers or goods.

(69) "Finished fuel" means a transportation fuel that is used directly in a vehicle for transportation purposes without requiring additional chemical or physical processing.

(70) "First fuel reporting entity" means the first entity responsible for reporting in the WFRS for a given amount of fuel. This entity initially holds the status as the fuel reporting entity and the credit or deficit generator for this fuel amount, but may transfer either status pursuant to WAC 173-424-200 or 173-424-210.

(71) "Fixed guideway" means a public transportation facility using and occupying a separate right of way for the exclusive use of public transportation using rail, a fixed catenary system, trolley bus, streetcar, or an aerial tramway.

(72) "Fossil" means any naturally occurring flammable mixture of hydrocarbons found in geologic formations such as rock or strata. When used as an adjective preceding a type of fuel (e.g., "fossil gasoline," or "fossil LNG"), it means the subset of that type of fuel that is derived from a fossil source.

(73) "Fuel cell" means a technology that uses an electrochemical reaction to generate electrical energy by combining atoms of hydrogen and oxygen in the presence of a catalyst.

(74) "Fuel pathway" means a detailed description of all stages of fuel production and use for any particular transportation fuel, including feedstock generation or extraction, production, distribution, and combustion of the fuel by the consumer. The fuel pathway is used to calculate the carbon intensity of each transportation fuel through a complete well-to-wheel analysis of that fuel's life cycle greenhouse gas emissions.

(75) "Fuel pathway applicant" refers to an entity that has registered in the alternative fuel portal pursuant to WAC 173-424-300 and has submitted an application including all required documents and attestations in support of the application requesting a certified fuel pathway.

(76) "Fuel pathway code" or "FPC" means the identifier used in the WFRS that applies to a specific fuel pathway as approved or issued under WAC 173-424-600 through 173-424-630.

(77) "Fuel pathway holder" means a fuel pathway applicant that has received a certified fuel pathway carbon intensity based on site-specific data, including a provisional fuel pathway from ecology, or who has a certified fuel pathway code from the California air resources board or Oregon department of environmental quality that has been approved for use in Washington by ecology.

(78) "Fuel production facility" means the facility at which a regulated or opt-in fuel is produced. With respect to biomethane, a fuel production facility means the facility at which the fuel is upgraded, purified, or processed to meet the standards for injection to a natural gas common carrier pipeline or for use in natural gas vehicles.

(79) "Fuel reporting entity" means an entity that is required to report fuel transactions in the WFRS pursuant to WAC 173-424-200 through 173-424-220. Fuel reporting entity refers to the first fuel reporting entity and to any entity to whom the reporting entity status is passed for a given quantity of fuel.

(80) "Fuel supply equipment" refers to equipment registered in the WFRS that dispenses alternative fuel into vehicles including, but not limited to, electric vehicle chargers, hydrogen fueling stations, and natural gas fueling equipment.

(81) "Gasoline" means a fuel suitable for spark ignition engines and conforming to the specifications of ASTM D4814.

(82) "Heavy-duty vehicle" or "HDV" means a vehicle that is rated at or greater than 14,001 pounds gross vehicle weight rating (GVWR).

(83) "Home fueling" means the dispensing of fuel by use of a fueling appliance that is located on or within a residential property with access limited to a single household.

(84) "Hybrid electric vehicle (HEV)" means any vehicle that can draw propulsion energy from both of the following on-vehicle sources of stored energy:

(a) A consumable fuel; and

(b) An energy storage device, such as a battery, capacitor, or flywheel.

(85) "Hydrogen station capacity evaluator" or "HySCapE" means a tool developed by the National Renewable Energy Laboratory to determine the dispensing capacity of a hydrogen station, HySCapE Version 1.0 (August 13, 2018).

(86) "Illegitimate credits" means credits that were not generated in compliance with this chapter.

(87) "Import" means to have ownership title to transportation fuel at the time it is brought from outside Washington into Washington by any means of transport other than in the fuel tank of a motor vehicle for the purpose of propelling that motor vehicle.

(88) "Importer" means:

(a) With respect to any liquid fuel, the person who imports the fuel; or

(b) With respect to any biomethane, the person who owns the biomethane when it is either physically transported into Washington or injected into a pipeline located outside of Washington and contractually delivered for use in Washington through a book–and-claim accounting methodology.

(89) "Incremental credit" means a credit that is generated by an action to further lower the carbon intensity of electricity. Incremental credits are calculated from the difference between the carbon intensity of utility-specific electricity and the carbon intensity of renewable electricity.

(90) "Indirect land use change" means the average lifecycle greenhouse gas emissions caused by an increase in land area used to grow crops that is caused by increased use of crop-based transportation fuels, and expressed as grams of carbon dioxide equivalent per megajoule of energy provided (gCO2e/MJ). Indirect land use change values for biofuels are listed in Table 5 under WAC 173-424-900. Indirect land use change for fuel made from sugarcane, corn, sorghum, soybean, canola, and palm feedstocks is calculated using the protocol developed by the California air resources board.

(91) "Ineligible specified source feedstock" means a feedstock specified in WAC 173-424-600 (6)(a) through (c) that does not meet the chain-of-custody documentation requirements specified in WAC 173-424-600 (6)(d).

(92) "Invoice" means the receipt or other record of a sale transaction, specifying the price and terms of sale, that describes an itemized list of goods shipped.

(93) "Lifecycle greenhouse gas emissions" are:

(a) The aggregated quantity of greenhouse gas emissions, including direct emissions and significant indirect emissions, such as significant emissions from changes in land use associated with the fuels, as approved by ecology;

(b) Measured over the full fuel lifecycle, including all stages of fuel production, from feedstock generation or extraction, production, distribution, and combustion of the fuel by the consumer; and

(c) Stated in terms of mass values for all greenhouse gases as adjusted to CO2e to account for the relative global warming potential of each gas.

(94) "Light-duty vehicle" and "medium-duty vehicle" mean a vehicle category that includes both light-duty (LDV) and medium-duty vehicles (MDV).

(a) "LDV" means a vehicle that is rated at 8,500 pounds or less GVWR.

(b) "MDV" means a vehicle that is rated between 8,501 and 14,000 pounds GVWR.

(95) "Liquefied compressed natural gas" or "L-CNG" means natural gas that has been liquefied and transported to a dispensing station where it was then regasified and compressed to a pressure greater than ambient pressure.

(96) "Liquefied natural gas" or "LNG" means natural gas that has been liquefied.

(97) "Liquefied petroleum gas" or "propane" or "LPG" means a petroleum product composed predominantly of any of the hydrocarbons, or mixture thereof; propane, propylene, butanes, and butylenes maintained in the liquid state.

(98) "Liquid fuels" means fossil fuels (including gasoline, diesel, and conventional jet fuels), liquid alternative fuels (including ethanol, biomass-based fuels, and alternative jet fuels), and blend of liquid fossil and alternative fuels.

(99) "Low-carbon intensity (Low-CI) electricity" means any electricity that is determined to have a carbon intensity that is less than the average Washington grid or utility-specific, as applicable including, but not limited to, a renewable resource as defined in RCW 19.405.020(34).

(100) "Motor vehicle" means any vehicle, vessel, watercraft, engine, machine, or mechanical contrivance that is self-propelled.

(101) "M-RETS renewable thermal" means the electronic tracking and trading system for North American biomethane and other renewable thermal attributes run by the M-RETS organization. For the purposes of this division, only the biomethane or renewable natural gas certificates generated by this system are recognized.

(102) "Multifamily housing" means a structure or facility established primarily to provide housing that provides four or more living units, and where the individual parking spaces that an electric vehicle charger serves, and the charging equipment itself, are not deeded to or owned by a single resident.

(103) "Multifuel vehicle" means a vehicle that uses two or more distinct fuels for its operation. A multifuel vehicle (also called a vehicle operating in blended-mode) includes a bi-fuel vehicle and can have two or more fueling ports onboard the vehicle. A fueling port can be an electrical plug or a receptacle for liquid or gaseous fuel. For example, most plug-in hybrid electric vehicles use both electricity and gasoline as the fuel source and can be "refueled" using two separately distinct fueling ports.

(104) "Natural gas" means a mixture of gaseous hydrocarbons and other compounds with at least 80 percent methane by volume.

(105) "Ocean-going vessel" means a commercial, government, or military vessel meeting any one of the following criteria:

(a) A vessel greater than or equal to 400 feet in length overall;

(b) A vessel greater than or equal to 10,000 gross tons pursuant to the convention measurement (international system);

(c) A vessel propelled by a marine compression ignition engine with a per-cylinder displacement of greater than or equal to 30 liters.

(106) "OPGEE" or "OPGEE model" means the oil production greenhouse gas emissions estimator version 2.0 (June 20, 2018) posted at http://www.arb.ca.gov/fuels/lcfs/lcfs.htm, which is incorporated herein by reference.

(107) "Opt-in fuel reporting entity" means an entity that meets the requirements of WAC 173-424-120 and voluntarily opts in to be a fuel reporting entity and is therefore subject to the requirements set forth in this chapter.

(108) "Petroleum intermediate" means a petroleum product that can be further processed to produce gasoline, diesel, or other petroleum blendstocks.

(109) "Petroleum product" means all refined and semi-refined products that are produced at a refinery by processing crude oil and other petroleum-based feedstocks, including petroleum products derived from co-processing biomass and petroleum feedstock together. "Petroleum product" does not include plastics or plastic products.

(110) "Physical transport mode" means the applicable combination of actual fuel delivery methods, such as truck routes, rail lines, pipelines and any other fuel distribution methods through which the regulated party reasonably expects the fuel to be transported under contract from the entity that generated or produced the fuel, to any intermediate entities and ending in Washington. The fuel pathway holder and any entity reporting the fuel must demonstrate that the actual feedstock transport mode and distance conforms to the stated mode and distance in the certified pathway.

(111) "Plug-in hybrid electric vehicle" or "PHEV" means a hybrid electric vehicle with the capability to charge a battery from an off-vehicle electric energy source that cannot be connected or coupled to the vehicle in any manner while the vehicle is being driven.

(112) "Position holder" means any person that has an ownership interest in a specific amount of fuel in the inventory of a terminal operator. This does not include inventory held outside of a terminal, retail establishments, or other fuel suppliers not holding inventory at a fuel terminal.

(113) "Power purchase agreement" means a written agreement between an electricity service supplier and a customer that specifies the source or sources of electricity that will supply the customer.

(114) "Private access fueling facility" means a fueling facility with access restricted to privately-distributed electronic cards (cardlock) or is located in a secure area not accessible to the public.

(115) "Producer" means:

(a) With respect to any liquid fuel and renewable propane, the person who makes the fuel; or

(b) With respect to any biomethane, the person who refines, treats, or otherwise processes biogas into biomethane.

(116) "Product transfer document" or "PTD" means a document that authenticates the transfer of ownership of fuel from a fuel reporting entity to the recipient of the fuel. A PTD is created by a fuel reporting entity to contain information collectively supplied by other fuel transaction documents, including bills of lading, invoices, contracts, meter tickets, rail inventory sheets, renewable fuels standard (RFS) product transfer documents, etc.

(117) "Public access fueling facility" means a fueling facility that is not a private-access fueling dispenser.

(118) "Public transit agency" means an entity that operates a public transportation system.

(119) "Public transportation" means regular, continuing shared passenger-transport services along set routes which are available for use by the general public.

(120) "Rack" means a mechanism for delivering motor vehicle fuel or diesel from a refinery or terminal into a truck, trailer, railroad car, or other means of nonbulk transfer.

(121) "Registered party" means a regulated party, credit generator, aggregator, or an out-of-state fuel producer that has an ecology-approved registration under WAC 173-424-300 to participate in the clean fuels program.

(122) "Regulated fuel" means a transportation fuel identified under WAC 173-424-120(2).

(123) "Regulated party" means a person responsible for compliance with requirements listed under WAC 173-424-140(1).

(124) "Renewable fuel standard" means the program administered by the United States Environmental Protection Agency, under 40 C.F.R. Part 80: Regulation of fuels and fuel additives, Subpart M.

(125) "Renewable gasoline" means a spark ignition engine fuel that substitutes for fossil gasoline and that is produced from renewable resources.

(126) "Renewable hydrocarbon diesel" or "renewable diesel" means a diesel fuel that is produced from nonpetroleum renewable resources but is not a monoalkylester and which is registered as a motor vehicle fuel or fuel additive under 40 C.F.R. Part 79. This includes the renewable portion of a diesel fuel derived from co-processing biomass with a petroleum feedstock.

(127) "Renewable hydrocarbon diesel blend" or "renewable diesel blend" means a fuel comprised of a blend of renewable hydrocarbon diesel with petroleum-based diesel fuel, designated RXX. In the abbreviation RXX, the XX represents the volume percentage of renewable hydrocarbon diesel fuel in the blend.

(128) "Renewable hydrogen" means hydrogen produced using renewable resources both as the source for the hydrogen and the source for the energy input into the production process, as defined in RCW 19.405.020(32). It includes hydrogen derived from:

(a) Electrolysis of water or aqueous solutions using renewable electricity;

(b) Catalytic cracking or steam methane reforming of biomethane; or

(c) Thermochemical conversion of biomass, including the organic portion of municipal solid waste (MSW).

Renewable electricity, for the purpose of renewable hydrogen production by electrolysis, means electricity derived from sources that qualify as renewable energy resources as defined in RCW 19.405.020(34).

(129) "Renewable naphtha" means naphtha that is produced from nonpetroleum renewable resources.

(130) "Renewable propane" means liquefied petroleum gas (LPG or propane) that is produced from nonpetroleum renewable resources.

(131) "Residence" means a structure or facility established primarily to provide housing that provides less than four living units.

(132) "Site-specific data" and "site-specific input" means an input value used in determination of fuel pathway carbon intensity value, or the raw operational data used to calculate an input value, which is required to be unique to the facility, pathway, and feedstock. All site-specific inputs must be measured, metered or otherwise documented, and verifiable, e.g., consumption of natural gas or grid electricity at a fuel production facility must be documented by invoices from the utility.

(133) "Small importer of finished fuels" means any person who imports into Washington 500,000 gallons or less of finished fuels in a given calendar year. Any fuel imported by persons that are related, or share common ownership or control, shall be aggregated together to determine whether a person meets this definition.

(134) "Specified source feedstocks" are feedstocks for fuel pathways that require chain of custody evidence to be eligible for a reduced CI associated with the use of a waste, residue, by-product, or similar material under the pathway certification process under WAC 173-424-600.

(135) "Station operational status system (SOSS)" means a software database tool developed and maintained by California fuel cell partnership to publicly monitor the operational status of hydrogen stations.

(136) "Substitute fuel pathway code" means a fuel pathway code that is used to report transactions that are sales or purchases without obligation, exports, loss of inventory, not for transportation use, and exempt fuel use when the seller of a fuel does not pass along the credits or deficits to the buyer and the buyer does not have accurate information on the carbon intensity of the fuel or its blendstocks.

(137) "Technical corn oil" means inedible oil recovered from thin stillage or the distiller's grains and solubles produced by a dry mill corn ethanol plant, termed distiller's corn oil (DCO), or other nonfood grade corn oil from food processing operations.

(138) "Technical sorghum oil" means inedible oil recovered from thin stillage or the distiller's grains and solubles produced by a dry mill sorghum ethanol plant, termed distiller's sorghum oil (DSO), or other nonfood grade sorghum oil from food processing operations.

(139) "Therm" means a measure of the heat content of fuels or energy sources. One therm equals 100,000 Btu.

(140) "Tier 1 calculator," "simplified calculator," or "WA-GREET 3.0 Tier 1 calculator" means the tools used to calculate lifecycle emissions for commonly produced fuels, including the instruction manuals on how to use the calculators. Ecology will make available copies of these simplified calculators on its website (https://www.ecology.wa.gov). The simplified calculators used in the program are:

(a) Tier 1 simplified calculator for starch and corn fiber ethanol;

(b) Tier 1 simplified CI calculator for sugarcane-derived ethanol;

(c) Tier 1 simplified CI calculator for biodiesel and renewable diesel;

(d) Tier 1 simplified CI calculator for LNG and L-CNG from North American Natural Gas;

(e) Tier 1 simplified CI calculator for biomethane from North American landfills;

(f) Tier 1 simplified CI calculator for biomethane from anaerobic digestion of wastewater sludge;

(g) Tier 1 simplified CI calculator for biomethane from food, green, and other organic wastes; and

(h) Tier 1 simplified CI calculator for biomethane from AD of dairy and swine manure.

(141) "Tier 2 calculator" or "WA-GREET 3.0 model" means the tool used to calculate lifecycle emissions for next generation fuels, including the instruction manual on how to use the calculator. Next generation fuels include, but are not limited to, cellulosic alcohols, hydrogen, drop-in fuels, or first generation fuels produced using innovative production processes. Ecology will make available a copy of the Tier 2 calculator on its website (https://www.ecology.wa.gov).

(142) "Total amount (TA)" means the total quantity of fuel reported by a fuel reporting entity irrespective of whether the entity retained status as the credit or deficit generator for that specific fuel volume. TA is calculated as the difference between the fuel reported using transaction types that increase the net fuel quantity reported in the WFRS and fuel reported using transaction type that decrease the net fuel quantity reported in the WFRS. Transaction types that increase the TA include: Production in Washington, production for import, import, purchased with obligation, purchased without obligation, gain of inventory. Transaction types that decrease the TA include: Sold with obligation, sold without obligation, loss of inventory, export, not used for transportation.

(143) "Transaction date" means the title transfer date as shown on the product transfer document.

(144) "Transaction quantity" means the amount of fuel reported in a transaction. A transaction quantity must be reported in units, provided in Table 3 in WAC 173-424-900 and in the WFRS.

(145) "Transaction type" means the nature of the fuel transaction as defined below:

(a) "Produced in Washington" means the transportation fuel was produced at a facility in Washington;

(b) "Import within the bulk system" means the transportation fuel was produced outside of Washington and later imported into Washington and placed into the bulk system;

(c) "Import outside the bulk system" means the transportation fuel was imported into Washington and delivered outside the bulk system;

(d) "Purchased with obligation" means the transportation fuel was purchased with the compliance obligation passing to the purchaser;

(e) "Purchased without obligation" means the transportation fuel was purchased with the compliance obligation retained by the seller;

(f) "Sold with obligation" means the transportation fuel was sold with the compliance obligation passing to the purchaser;

(g) "Sold without obligation" means the transportation fuel was sold with the compliance obligation retained by the seller;

(h) "Position holder sale without obligation" means the transportation fuel was sold below the rack without a transfer of the compliance obligation;

(i) "Position holder sale with obligation" means the transportation fuel was sold below the rack with a transfer of the compliance obligation;

(j) "Position holder sale for export" means the transportation fuel was sold below the rack to an entity who exported the fuel;

(k) "Purchase below the rack for export" means the transportation fuel was purchased below the rack and exported;

(l) "Export" means a transportation fuel that was reported under the clean fuels program but was later moved from a location inside of Washington to a location outside of Washington, and is not used for transportation in Washington;

(m) "Loss of inventory" means the fuel exited the Washington fuel pool due to volume loss, such as through evaporation or due to different temperatures or pressurization;

(n) "Gain of inventory" means the fuel entered the Washington fuel pool due to a volume gain, such as through different temperatures or pressurization;

(o) "Not used for transportation" means a transportation fuel was reported with compliance obligation under the CFP but was later used in an application unrelated to the movement of goods or people in Washington, such as process heat at an industrial facility, home or commercial building heating, or electric power generation;

(p) "EV charging" means providing electricity to recharge EVs including BEVs and PHEVs;

(q) "LPGV fueling" means the dispensing of liquefied petroleum gas at a fueling station designed for fueling liquefied petroleum gas vehicles;

(r) "NGV fueling" means the dispensing of natural gas at a fueling station designed for fueling natural gas vehicles;

(s) "Exempt fuel use - aircraft," "exempt fuel use - racing activity vehicles," "exempt fuel use - military tactical and support vehicle and equipment," "exempt fuel use - locomotive," "exempt fuel use - watercraft," "exempt fuel use - farm vehicles, tractors, implements of husbandry," "exempt fuel use - motor trucks primary used to transport logs," "exempt fuel use - off-highway construction vehicles, all of which must meet WAC 173-424-130" means that the fuel was delivered or sold into the category of vehicles or fuel users that are exempt under WAC 173-424-130; or

(t) "Production for import into Washington" means the transportation fuel was produced outside of Washington and imported into Washington for use in transportation.

(146) "Transportation fuel" means gasoline, diesel, any other flammable or combustible gas or liquid and electricity that can be used as a fuel for the operation of a motor vehicle. Transportation fuel does not mean unrefined petroleum products.

(147) "Unbundled renewable energy credit" means a renewable energy credit that is sold, delivered, or purchased separately from electricity.

(148) "Unit of fuel" means fuel quantities expressed to the largest whole unit of measure, with any remainder expressed in decimal fractions of the largest whole unit.

(149) "Unit of measure" means either:

(a) The International System of Units defined in NIST Special Publication 811 (2008) commonly called the metric system;

(b) U.S. customer units defined in terms of their metric conversion factors in NIST Special Publications 811 (2008); or

(c) Commodity specific units defined in either:

(i) The NIST Handbook 130 (2015), Method of Sale Regulation; or

(ii) Chapter 16-662 WAC.

(150) "Unspecified source of electricity" or "unspecified source" means a source of electricity that is not a specified source at the time of entry into the transaction to procure the electricity. The generation of such electricity will be assigned an emissions factor of 0.437 metric tons per megawatt-hour of electricity as measured by the utility at the first point of receipt in Washington, unless ecology assigns another number as directed by RCW 19.405.070(2). This includes the GHG emission factor 0.428 metric tons per megawatt-hour for electricity generation, and the two percent GHG emissions due to transmission losses between the point of generation and the first point of receipt in Washington.

(151) "Used cooking oil" or "UCO" means fats and oils originating from commercial or industrial food processing operations, including restaurants that have been used for cooking or frying. Feedstock characterized as UCO must contain only fats, oils, or greases that were previously used for cooking or frying operations. UCO must be characterized as "processed UCO" if it is known that processing has occurred prior to receipt by the fuel production facility or if evidence is not provided to the verifier or ecology to confirm that it is "unprocessed UCO."

(152) "Utility renewable electricity product" means a product where a utility customer has elected to purchase renewable electricity through a product that retires renewable energy certificates (RECs) or represents a bundled purchase of renewable electricity and its RECs.

(153) "Validation" means verification of a fuel pathway application.

(154) "Verification" means a systematic, independent, and documented process for evaluation of reported data against the requirements specified in this chapter.

(155) "Washington fuels reporting system" or "WFRS" means the interactive, secured, web-based, electronic data tracking, reporting, and compliance system that ecology develops, manages, and operates to support the clean fuels program.

(156) "WFRS reporting deadlines" means the quarterly and annual reporting dates in WAC 173-424-410 and 173-424-430.

(157) "WA-GREET" means the greenhouse gases, regulated emissions, and energy in transportation (GREET) model developed by Argonne National Laboratory that ecology modifies and maintains for use in the Washington clean fuels program. The most current version WA-GREET 3.0 is adapted from California's CA-GREET 3.0 (August 13, 2018). The model includes contributions from the oil production greenhouse gas estimator (OPGEE2.0) model (for emissions from crude extraction) and global trade analysis project (GTAP-BIO) together with the agro-ecological zone emissions factor (AEZ-EF) model for land use change (LUC). Ecology will make available a copy of WA-GREET 3.0 on its website (www.ecology.wa.gov). As used in this rule, WA-GREET refers to both the full model and the fuel-specific simplified calculators that the program has adopted.

(158) "Yard trucks" means an off-road mobile utility vehicle used to carry cargo containers with or without chassis; also known as utility tractor rig (UTR), yard tractor, yard goat, yard hostler, yard hustler, or prime mover. For the purpose of CFP crediting, an electric yard truck is considered a heavy-duty truck.

(159) "Yellow grease" means a commodity produced from a mixture of:

(a) Used cooking oil; and

(b) Rendered animal fats that were not used for cooking.

This mixture often is combined from multiple points of origin. Yellow grease must be characterized as "animal fat" if evidence is not provided to the verifier or ecology to confirm the quantity that is animal fat and the quantity that is used cooking oil.

Abbreviations. For the purposes of this chapter, the following acronyms apply.

"AEZ-EF" means agro-ecological zone emissions factor model.

"AFP" means alternative fuel portal.

"AJF" means alternative jet fuel.

"ASTM" means ASTM International (formerly American Society for Testing and Materials).

"BEV" means battery electric vehicles.

"WA-GREET" means Washington-modified greenhouse gases, regulated emissions, and energy use in transportation model.

"CARB" means California air resources board.

"CA-GREET" means the California air resources board adopted version of GREET model.

"CCM" means credit clearance market.

"CEC" means California energy commission.

"CFP" means clean fuels program established under this chapter to implement chapter 70A.535 RCW.

"CFR" means Code of Federal Regulations.

"CFS" means clean fuel standard or carbon intensity standard.

"CHAdeMO" means charge de move, a DC fast charging protocol.

"CI" means carbon intensity.

"CNG" means compressed natural gas.

"DC" means direct current.

"DCO" means distiller's corn oil or technical corn oil.

"DSO" means distiller's sorghum oil or technical sorghum oil.

"eCHE" means electric cargo handling equipment.

"EDU" means electrical distribution utility.

"EER" means energy economy ratio.

"eFV" means electrical power for a ferry vessel.

"eGSE" means electric ground support equipment.

"eTRU" means electric transport refrigeration unit.

"eOGV" means electric ocean-going vessel.

"EV" means electric vehicle.

"FCV" means fuel cell vehicle.

"FCI" means direct current fast charging infrastructure.

"FEIN" means federal employer identification number.

"FPC" means fuel pathway code.

"FSE" means fueling supply equipment.

"(gCO2e/MJ)" means grams of carbon dioxide equivalent per megajoule.

"GTAP" means the global trade analysis project model.

"GVWR" means gross vehicle weight rating.

"HySCapE" means hydrogen station capacity evaluator.

"H2" means hydrogen.

"HDV" means heavy-duty vehicles.

"HDV-CIE" means a heavy-duty vehicle compression-ignition engine.

"HDV-SIE" means a heavy-duty vehicle spark-ignition engine.

"HEV" means hybrid electric vehicle.

"HRI" means hydrogen refueling infrastructure.

"ICEV" means internal combustion engine vehicle.

"LUC" means land use change.

"LCA" means life cycle analysis.

"L-CNG" means liquefied compressed natural gas.

"LDV" means light-duty vehicles.

"LNG" means liquefied natural gas.

"LPG" means liquefied petroleum gas.

"LPGV" means liquefied petroleum gas vehicle.

"MCON" means marketable crude oil name.

"MDV" means medium-duty vehicles.

"MMBtu" means million British thermal units.

"MT" means metric tons (of carbon dioxide equivalent).

"NG" means natural gas.

"NGV" means a natural gas vehicle.

"OPGEE" means oil production greenhouse gas emissions estimator model.

"OR-DEQ" means Oregon department of environmental quality.

"PHEV" means plug-in hybrid vehicles.

"PTD" means product transfer document.

"REC" means renewable energy certificate.

"RTC" means renewable thermal certificate.

"RNG" means renewable natural gas or biomethane.

"RFS" means the renewable fuel standard implemented by the U.S. Environmental Protection Agency.

"SAE CCS" means Society of Automotive Engineers combined charging system, a DC fast charging protocol.

"SMR" means steam methane reformation.

"SOSS" means station operational status system.

"UCO" means used cooking oil.

"U.S. EPA" means the United States Environmental Protection Agency.

"WFRS" means Washington fuels reporting system, the electronic reporting, trading, and compliance platform for the clean fuels program.

"WREGIS" means the western renewable energy generation information system run by the western electricity coordinating council.

[Statutory Authority: Chapter 70A.535 RCW. WSR 22-24-004 (Order 21-04), § 173-424-110, filed 11/28/22, effective 12/29/22.]

PDF173-424-120

Applicability.

(1) Except as exempted in WAC 173-424-130, this rule applies to:

(a) Any transportation fuel, as defined in WAC 173-424-110, that is sold, supplied, or offered for sale in Washington; and

(b) Any fuel reporting entity, as defined in WAC 173-424-110 and specified in WAC 173-424-200 through 173-424-220 is responsible for reporting a transportation fuel in a calendar year.

(2) Regulated fuels. This rule applies to the following types of transportation fuels including, but not limited to:

(a) Gasoline;

(b) Diesel or diesel fuel;

(c) Fossil compressed natural gas (fossil CNG), fossil liquefied natural gas (fossil LNG), or fossil liquefied compressed natural gas (fossil L-CNG);

(d) Compressed or liquefied hydrogen (hydrogen);

(e) A fuel blend containing greater than 10 percent ethanol by volume;

(f) A fuel blend containing biomass-based diesel;

(g) Denatured fuel ethanol (E100);

(h) Neat biomass-based diesel (B100 or R100);

(i) Fossil LPG/propane; and

(j) Other liquid or nonliquid transportation fuels as determined by ecology.

(3) Opt-in fuel.

(a) Each fuel in (b) of this subsection is presumed to meet the carbon intensity standards (benchmarks) in WAC 173-424-900 Table 1 and 2 for a specific year.

(b) A fuel provider for the following alternative fuels may generate CFP credits for such fuels by electing to opt into the CFP as an opt-in fuel reporting entity under WAC 173-424-140(2) and meeting all applicable requirements of the CFP:

(i) Electricity;

(ii) Bio-CNG;

(iii) Bio-LNG;

(iv) Bio-L-CNG;

(v) Alternative jet fuel; and

(vi) Renewable propane or renewable LPG.

(4) Annual carbon intensity benchmarks for an alternative fuel intended for use in a single-fuel vehicle.

(a) Gasoline and gasoline substitutes. A regulated party or credit generator must comply with the benchmarks for gasoline and gasoline substitutes in WAC 173-424-900 Table 1 for alternative fuel intended to be used in a single-fuel light-duty or medium-duty vehicle.

(b) Diesel and diesel substitute. A regulated party or credit generator must comply with the benchmarks for diesel fuel and diesel fuel substitutes in WAC 173-424-900 Table 2 for alternative fuel intended to be used in a single-fuel application other than a single-fuel light-duty or medium-duty vehicle.

(c) Carbon intensity benchmarks for transportation fuels intended for use in multifuel vehicles. Credit and deficit calculations for alternative fuel provided for use in a multifueled vehicle shall be established via:

(i) The benchmarks for gasoline set forth in WAC 173-424-900 Table 1 if one of the fuels used in the multifuel vehicle is gasoline; or

(ii) The benchmarks for diesel fuel set forth in WAC 173-424-900 Table 2 if one of the fuels used in the multifuel vehicle is diesel fuel.

[Statutory Authority: Chapter 70A.535 RCW. WSR 22-24-004 (Order 21-04), § 173-424-120, filed 11/28/22, effective 12/29/22.]

PDF173-424-130

Exemptions.

(1) Exempt fuels. The CFP rule does not apply to transportation fuel supplied in Washington if an aggregated quantity of less than 360,000 gasoline gallon equivalent (42.6 million MJ) per year as measured by all providers of such fuel.

(2) Exempt fuel uses.

(a) Transportation fuels supplied for use in any of the following motor vehicles are exempt from regulated fuels definition:

(i) Aircraft. This includes conventional jet fuel or aviation gasoline, and alternative jet fuel;

(ii) Vessels;

(iii) Railroad locomotive applications; and

(iv) Military tactical vehicles and tactical support equipment.

(b) The following transportation fuels are exempt from carbon intensity reduction requirements until January 1, 2028:

(i) Special fuel used in off-road vehicles used primarily to transport logs;

(ii) Dyed special fuel used in vehicles that are not designed primarily to transport persons or property, that are not designed to be primarily operated on highways, and that are used primarily for construction work including, but not limited to, mining and timber harvest operations; and

(iii) Dyed special fuel used for agricultural purposes exempt from chapter 82.38 RCW.

(c) Fuels listed under (a) and (b) of this subsection are eligible to generate credits.

(3) To claim exemption for regulated fuel under subsection (2) of this section, the regulated party must document that the fuel was supplied for use in motor vehicles listed in subsection (2) of this section.

(a) The method of documentation must include:

(i) Individual receipts or invoices for each fuel sale claimed as exempt that list the specific customer and exempt vehicle type;

(ii) If the fuel is sold through a dedicated tank for a single customer, electronic or paper records that document that the customer's vehicle(s) being fueled are in an exempt category under subsection (2) of this section, and that the tank is not used to fuel any other vehicles; or

(iii) Other comparable documentation approved in writing by ecology and prior to exemptions being claimed. The documentation must, at a minimum:

(A) Establish that the fuel was sold through a dedicated source or single supplier to use in one of the specified motor vehicles listed in subsection (2) of this section; or

(B) For each fuel transaction if the fuel is not sold through a dedicated source.

(b) The person asserting the exemption of fuel under subsection (2) of this section must maintain the records specified under subsection (2)(a) of this section for seven years, and submit to ecology upon request, records demonstrating adherence to these conditions.

[Statutory Authority: Chapter 70A.535 RCW. WSR 22-24-004 (Order 21-04), § 173-424-130, filed 11/28/22, effective 12/29/22.]

PDF173-424-140

General requirements.

(1) Regulated party.

(a) Regulated fuels producers in Washington, or importers into Washington, must comply with the requirements of this rule.

(b) The regulated parties for regulated fuels are designated under WAC 173-424-200.

(c) The regulated parties for regulated fuels must:

(i) Register under WAC 173-424-300;

(ii) Keep records under WAC 173-424-400;

(iii) Report quarterly under WAC 173-424-410 and annually under WAC 173-424-430; and

(iv) Comply with the clean fuel standard for:

(A) Gasoline and gasoline substitutes in WAC 173-424-900 Table 1; or

(B) Diesel fuel and diesel fuel substitutes in WAC 173-424-900 Table 2.

(2) Opt-in fuel reporting entity.

(a) An out-of-state producer of ethanol, biodiesel, renewable diesel, alternative jet fuel, renewable natural gas, or renewable propane that is not an importer is not required to participate in the CFP. Any out-of-state producer that is not an importer who chooses voluntarily to participate in the CFP may retain the ability to generate credits or deficits for the specific volumes of their fuel that is imported into Washington, only if it opts in as a first fuel reporting entity and meets the requirements of WAC 173-424-200 and 173-424-210.

(b) Opting in procedure: Opting into the CFP becomes effective when the opt-in entity establishes an account in the WFRS, pursuant to the voluntary participation under subsection (4) of this section. The opt-in entity may not report and generate credits and deficits based on transactions that precede the quarter in which the entity opted in.

(c) A fuel supplier choosing to opt-in to the CFP under WAC 173-424-120 must:

(i) Register as required by WAC 173-424-300;

(ii) Keep records as required under WAC 173-424-400;

(iii) Report quarterly and annually under WAC 173-424-410 and 173-424-430.

(d) Opting out procedure. In order to opt-out of the CFP, an opt-in entity must complete the following:

(i) Provide ecology a 90-day notice of intent to opt-out and a proposed effective opt-out date;

(ii) Submit in the WFRS any outstanding quarterly fuel transactions up to the quarter in which the effective opt-out date falls and a final annual compliance report that covers the year through the opt-out date; and

(iii) Identify in the 90-day notice any actions to be taken to eliminate any remaining deficits by the effective opt-out date.

(3) Credit aggregator requirements.

(a) Aggregators must:

(i) Register according to WAC 173-424-300;

(ii) Keep records as required under WAC 173-424-400;

(iii) Report quarterly as required under WAC 173-424-410; and

(iv) Report annually as required under WAC 173-424-430.

(b) Designation of aggregator.

(i) A regulated party or an eligible credit generator may designate an aggregator to act on its behalf to facilitate credit generation and trade credits by submitting an aggregator designation form to ecology. Aggregators may register under WFRS only if a regulated party or an eligible credit generator has authorized an aggregator to act on its behalf by submitting a complete and valid aggregator designation form to ecology.

(ii) Aggregator designations may only take effect at the start of the next full calendar quarter after ecology receives such notice.

(iii) A regulated party or credit generator already registered with the program may also serve as an aggregator for others;

(iv) An aggregator must notify ecology when a credit generator or regulated party has withdrawn designation of the aggregator. Aggregator withdrawals may only take effect at the end of the current full calendar quarter when ecology receives such notice.

(4) Voluntary participation. Voluntary participation in the CFP shall conclusively establish consent to be subject to the jurisdiction of the state of Washington, its courts, and the administrative authority of ecology to implement the CFP. Failure to consent to such jurisdiction excludes participation in the CFP.

[Statutory Authority: Chapter 70A.535 RCW. WSR 22-24-004 (Order 21-04), § 173-424-140, filed 11/28/22, effective 12/29/22.]

PART 2 – DESIGNATION OF REGULATED PARTIES AND CREDIT GENERATORS

PDF173-424-200

Designation of fuel reporting entities for liquid fuels.

(1) Applicability. The purpose of this section is to identify the first fuel reporting entities, any subsequent fuel reporting entities, and the credit or deficit generator for liquid fuels. The first reporting entity is responsible for initiating reporting for a given amount of fuel within the online reporting system according to WAC 173-424-400 and, by default, holds the status as the initial credit or deficit generator. This section so prescribes the transfer of fuel reporting, and credit and deficit generating status.

(2) Designation.

(a) Designation of first fuel reporting entities for liquid fuels.

(i) The first fuel reporting entity for liquid fossil fuels is the producer or importer of the liquid fossil fuel.

(ii) For liquid fuels that are a blend of liquid alternative fuel components and a fossil fuel component, the first fuel reporting entity is the following:

(A) The producer or importer of alternative fuels for the alternative fuel component; and

(B) The producer or importer of liquid fossil fuels for the fossil fuel component.

(iii) Conventional jet fuel is not subject to the CFP and need not be reported.

(b) Designation of fuel reporting entities in case of transfer of liquid fuel ownership. An entity transferring ownership of fuel is the "transferor," and an entity acquiring ownership of fuel is the "recipient."

(i) Transferring status as credit or deficit generator.

(A) An entity can voluntarily transfer its status as a credit or deficit generator for a given amount of liquid fuel simultaneously with the ownership of such fuel if the conditions in (b)(i)(A)(I) through (IV) of this subsection are met:

(I) The two entities agree by written contract that specifies the recipient accepts all the responsibilities of a fuel reporting entity and credit and/or deficit generator;

(II) In case of a deficit generating fuel, the two entities agree by written contract that specifies which party is responsible for accounting for the deficit in the annual credits and deficits balance calculation;

(III) The transferor provides the recipient a product transfer document that specifies the recipient is the credit or deficit generator; and

(IV) Transfer of credit or deficit generator status is not the result of a downstream entity acquiring ownership of liquid fuel below the rack. The downstream entity is required to report on WFRS-CBTS, if exports the fuel.

(B) Upon transfer, the recipient also becomes the fuel reporting entity for the fuel, while the transferor remains still subject to reporting requirements and to any other requirement applicable to a fuel reporting entity.

(ii) Retaining status as credit or deficit generator.

(A) An entity can retain its status as a credit or deficit generator for a given amount of liquid fuel, while transferring ownership of that fuel, if the following conditions are met at the time ownership of fuel is transferred:

(I) The two entities agree by written contract that specifies the recipient accepts all the responsibilities of a fuel reporting entity, and the transferor retains the responsibilities as a fuel reporting entity and credit or deficit generator;

(II) In case of a deficit generating fuel, the two entities agree by written contract that specifies which party is responsible for accounting for the deficit in the annual credits and deficits balance calculation; and

(III) The transferor must provide the recipient a product transfer document that specifies the transferor is the credit or deficit generator according to WAC 173-424-400.

(B) Upon transfer according to (b)(ii)(A) of this subsection, the recipient also becomes a fuel reporting entity for the fuel while the transferor is still subject to reporting requirements and any other requirements applicable to a fuel reporting entity under this chapter.

(iii) Transfer period.

(A) For all liquid fuels, the maximum period in which credit or deficit generator status can be transferred to another entity, for a given amount of fuel, is limited to three calendar quarters starting from and including the quarter in which the entity received the title. After this period is over, the credit and deficit generator status for that amount of fuel cannot be transferred.

(B) After this period is over, the credit and deficit generator status for that amount of fuel cannot be transferred.

(iv) Designation of fuel exporter. Entities responsible for reporting exports of fuel that has been previously reported in the WFRS are identified below:

(A) When the fuel is sold or delivered above the rack for export, the entity holding the ownership title to the fuel as it crosses the Washington border on its way toward the first point of sale/delivery out-of-state is responsible for reporting the export.

(B) When the fuel is sold across the rack for export, the entity holding title to the fuel as the fuel crosses the rack is responsible for reporting.

(C) When the fuel is diverted out-of-state below the rack, the entity holding title to the fuel, as it crosses the Washington border, is responsible for reporting the export.

[Statutory Authority: Chapter 70A.535 RCW. WSR 22-24-004 (Order 21-04), § 173-424-200, filed 11/28/22, effective 12/29/22.]

PDF173-424-210

Fuel reporting entities for gaseous fuels.

(1) Applicability. This section applies to providers of both fossil and bio-based compressed natural gas, liquefied natural gas, liquefied compressed natural gas, and liquefied petroleum gas (or propane), and hydrogen used as transportation fuels in Washington.

(2) Designation of first fuel reporting entities for gaseous fuels. The first fuel reporting entity for different gaseous fuels is identified below:

(a) Bio-CNG. For bio-CNG, including the bio-CNG portion of a blend with fossil CNG, the first fuel reporting entity is the producer or importer of the biomethane.

(b) Bio-LNG and bio-L-CNG. For bio-LNG and bio-L-CNG, including the biomethane portion of any blend with fossil LNG and L-CNG, the first fuel reporting entity is the producer or importer of the biomethane.

(c) Renewable propane. For renewable propane, including the renewable propane portion of a blend with fossil propane, the first fuel reporting entity is the producer or importer of the renewable propane.

(d) Fossil CNG, LNG, L-CNG and propane.

(i) For fossil CNG, LNG, L-CNG, and propane, including the fossil portion of any blend with a renewable fuel component, the first fuel reporting entity is the entity that owns the fueling equipment through which the fossil fuel is dispensed to motor vehicles for transportation use.

(ii) Forklift: The first fuel reporting entity for fossil propane used in forklifts is the forklift fleet owner.

(e) Hydrogen.

(i) Motor vehicles. The first fuel reporting entity for fossil based hydrogen is the entity that owns the fueling supply equipment through which hydrogen fuel is dispensed to motor vehicles for transportation use.

(ii) Forklift. The first fuel reporting entity for fossil based hydrogen used in fuel cell forklifts is the forklift fleet owner.

(iii) Renewable hydrogen. For renewable hydrogen, including the renewable portion of any blend with fossil hydrogen, the first fuel reporting entity is the producer or importer of the renewable hydrogen.

(3) Designating another entity as fuel reporting entity. An entity may elect not to be the first fuel reporting entity for a given gaseous fuel, provided that another entity has contractually agreed to be the fuel reporting entity for the fuel on its behalf. In such cases, the two entities must agree by written contract that:

(a) The original first fuel reporting entity will not generate credits or deficits in the CFP under subsection (2)(a) through (e) of this section. Instead, the original first reporting entity will provide the amount of fuel dispensed, and other required information, to the contractually designated entity for the purpose of CFP reporting, and credit or deficit generation.

(b) The contractually designated entity accepts all CFP responsibilities as the first fuel reporting entity, and as a credit or deficit generator, as applicable.

[Statutory Authority: Chapter 70A.535 RCW. WSR 22-24-004 (Order 21-04), § 173-424-210, filed 11/28/22, effective 12/29/22.]

PDF173-424-220

Designation of fuel reporting entity for electricity.

(1) Applicability. This section prescribes how credits are generated for electricity when used as a transportation fuel.

(2) Responsibilities to generate credits. To receive credits for electricity supplied as a transportation fuel, an entity subject to this section must:

(a) Establish an account in the online system;

(b) Comply with registration, recordkeeping, and reporting requirements.

(3) Designating another entity as credit generator. A person who is eligible to generate credits as described in subsections (4) through (11) of this section may elect to designate another entity to be the credit generator if the two entities agree by written contract that:

(a) The credit generator outlined in subsections (4) through (11) of this section will provide the electricity data to the designated entity.

(b) The designated entity accepts all CFP responsibilities as the fueling reporting entity and credit generator.

(4) Nonresidential electric vehicle charging. For electricity used to charge an electric vehicle at nonresidential locations, such as in public for a fleet, at a workplace, or at multifamily housing sites, the eligible entities that generate credits are:

(a) The owner of the electric-charging equipment may generate credits from each piece of equipment.

(b) If the owner of the electric-charging equipment does not generate the credits, then an electric utility or its designated entity may generate the credit, if the two entities agree by written contract that:

(i) The owner of the charging equipment will provide the electricity data to the designated entity.

(ii) The designated entity accepts all CFP responsibilities as the fueling reporting entity and credit generator.

(5) Public transit systems. For electricity used to power transit buses, ferry vessels, or fixed guideway vehicles such as light rail systems, streetcars, or aerial tram, the transit agency operating the system is eligible to generate the credits for the electricity used to propel the system.

(6) Electric forklifts.

(a) For electricity used as transportation fuel supplied to electric forklifts, the fleet owner is the fuel reporting entity and the credit generator. The forklift owner must annually notify in writing to the forklift operator that:

(i) The owner is generating credit for the amount of electricity the operator uses for the electric forklifts.

(ii) The estimated annual credits and credit revenue the owner gets for the use of electricity in the forklift based on the credit price in the previous year. For the 2023 calendar year, the owner shall use the average of the annual average credit price in CARB and OR-DEQ clean fuel standard programs.

(b) If the fleet owner does not generate the credits, then the forklift operator may generate the credit if the two entities agree by written contract that:

(i) The fleet owner will not generate credits.

(ii) The forklift operator accepts all the CFP responsibilities as the fuel reporting entity and credit generator.

(c) If credit generation rights are passed to the forklift operator, the forklift operator must annually notify in writing to the forklift owner that:

(i) The operator is generating credit for the amount of electricity they use for the electric forklifts.

(ii) The estimated annual credits and credit revenue the operator gets for the use of electricity in the forklift based on the credit price in the previous year. For the 2023 calendar year, the operator shall use the average of the annual average credit price in CARB and OR-DEQ clean fuel standard programs.

(7) Electric transport refrigeration units (eTRU). For electricity supplied to the eTRU, the eTRU fleet owner is the fuel reporting entity and the credit generator.

(8) Electric cargo handling equipment (eCHE).

(a) For electricity supplied to eCHE, the electric cargo handling equipment owner is the fuel reporting entity and the credit generator.

(b) The eCHE owner must annually notify in writing to the eCHE operator that:

(i) The owner is generating credit for the amount of electricity the operator uses for the cargo handling equipment.

(ii) The estimated annual credit revenue the owner gets for the use of electricity in the cargo handling equipment based on the credit price in the previous year. For the 2023 calendar year, the owner shall use the average of the annual average credit price in CARB and OR-DEQ clean fuel standard programs.

(c) If the eCHE owner does not generate the credits, then the eCHE operator may generate the credit if the two entities agree by written contract that:

(i) The eCHE owner will not generate credits.

(ii) The eCHE operator accepts all the CFP responsibilities as the fuel reporting entity and credit generator.

(d) If credit generation rights are passed to the eCHE operator, the operator must annually notify in writing to the eCHE owner that:

(i) The operator is generating credit for the amount of electricity they use for the electric cargo handling equipment.

(ii) The estimated annual credits and credit revenue the operator gets for the use of electricity in the eCHE based on the credit price in the previous year. For the 2023 calendar year, the operator shall use the average of the annual average credit price in CARB and OR-DEQ clean fuel standard programs.

(9) Electric power for ocean-going vessel (eOGV).

(a) For electricity supplied to the eOGV, the owner of the electric fuel supply equipment is the fuel reporting entity and the credit generator.

(b) If the owner of the electric fuel supply equipment does not generate the credits, then the operator of the electric fuel supply equipment may generate the credit if the two entities agree by written contract that:

(i) The owner of the electric fuel supply equipment will not generate credits.

(ii) The operator of the electric fuel supply equipment accepts all the CFP responsibilities as the fuel reporting entity and credit generator.

(10) Electric ground support equipment.

(a) The owner of the charging equipment for ground support equipment is eligible to generate credits.

(b) If the owner of the charging equipment does not generate the credits, then the owner of the electric ground support equipment may generate the credit if the two entities agree by written contract that:

(i) The owner of the charging equipment will not generate credits.

(ii) The owner of the electric ground support equipment accepts all the CFP responsibilities as the fuel reporting entity and credit generator.

(11) Residential electric vehicle charging.

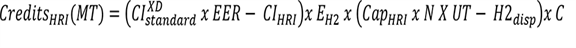

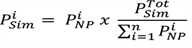

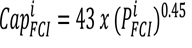

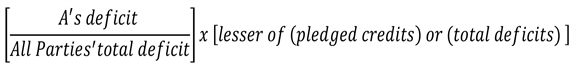

(a) Base credit. For electricity used to charge an electric vehicle in a residence, the following entities are eligible to generate base credits: